The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

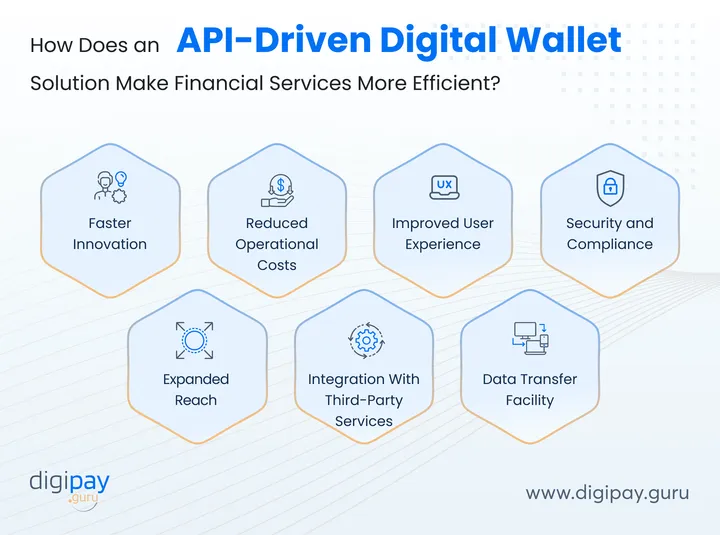

Digital Wallet Integrations: A Match Made in Payment Heaven

Discover the secret to seamless transactions! Unveil the power of digital wallet integrations and transform your payment experience today!

How Digital Wallet Integrations Can Enhance Your Payment Experience

In today's fast-paced digital economy, digital wallet integrations are transforming the way consumers engage with payment systems. These solutions, which encompass platforms like PayPal, Apple Pay, and Google Wallet, offer an array of benefits that streamline transactions and boost user satisfaction. By allowing users to store multiple payment methods securely in one place, digital wallets facilitate faster checkouts and reduce cart abandonment rates. Moreover, their compatibility with various e-commerce platforms means that businesses can cater to a broader audience, providing a seamless payment experience that enhances customer loyalty.

Implementing digital wallet integrations can significantly improve your payment experience in several ways:

- Convenience: Customers can pay using stored payment information with just a few taps, minimizing friction during the checkout process.

- Security: Digital wallets encrypt sensitive information, providing an added layer of security against fraud.

- Rewards and Offers: Many digital wallets come with promotional offers or reward points, incentivizing usage among consumers.

By leveraging the advantages of these technologies, businesses not only enhance their payment experience but also drive higher conversion rates and improve overall customer satisfaction.

Counter-Strike is a popular multiplayer first-person shooter game that has captivated gamers since its release. Players can engage in intense tactical battles, and part of the excitement includes the opportunity to enhance their gaming experience with various promotions and offers. For example, using a betpanda promo code can unlock special bonuses that enhance gameplay and provide unique advantages. The game's competitive nature and ever-evolving strategies keep players coming back for more.

The Benefits of Implementing Multiple Digital Wallets for Your Business

Implementing multiple digital wallets can significantly enhance the customer experience by providing flexibility and convenience. With the rise of contactless payments, consumers expect a seamless checkout process. By integrating various digital wallets such as PayPal, Apple Pay, and Google Wallet, businesses can cater to a broader audience. This versatility not only boosts customer satisfaction but can also translate into higher conversion rates as customers are more likely to complete purchases when their preferred payment method is available.

Furthermore, having multiple digital wallets can improve your business's security and reduce transaction costs. Many digital wallets offer robust fraud protection measures, ensuring that both your business and your customers feel secure during transactions. Additionally, some wallets provide lower processing fees compared to traditional credit card transactions, allowing businesses to retain a larger portion of their revenues. In today's digital landscape, implementing multiple digital wallets is not just a convenience; it's a strategic advantage for any forward-thinking business.

Is Your Business Ready for a Digital Wallet Integration? Key Considerations

As the popularity of digital wallets continues to rise, businesses need to ask themselves, Is your business ready for a digital wallet integration? Integrating digital wallet solutions can streamline payment processes, enhance customer experience, and potentially increase sales. However, before jumping in, it's essential to assess several key factors. First, consider the target audience; understanding their preferred payment methods can guide your integration strategy. Additionally, evaluate your current payment infrastructure and ensure it can support new technologies without significant overhaul costs.

Another crucial consideration is security. Digital wallets often handle sensitive customer information, making it imperative to prioritize secure integration methods. Invest in robust encryption technologies and stay updated on compliance regulations related to financial transactions. Finally, don’t overlook the importance of staff training; ensure your team understands the new system to provide seamless customer support. By carefully considering these elements, you can make an informed decision about whether your business is truly ready for digital wallet integration.