The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

Crypto Regulation Unplugged: The Facts Behind the Fuzz

Uncover the truth behind crypto regulation! Dive into the facts that cut through the confusion and explore what it means for your investments.

Understanding the Key Players in Crypto Regulation: Who's in Control?

As the cryptocurrency market continues to expand, understanding the key players in crypto regulation becomes crucial. Broadly speaking, the regulatory landscape is shaped by several institutions including government bodies, financial regulatory authorities, and international organizations. In the United States, for example, the Securities and Exchange Commission (SEC) plays a pivotal role by overseeing securities laws that impact various cryptocurrencies, while the Commodity Futures Trading Commission (CFTC) regulates derivatives trading. Likewise, globally, organizations like the Financial Action Task Force (FATF) provide guidelines that member countries implement to combat money laundering and terrorist financing related to digital assets.

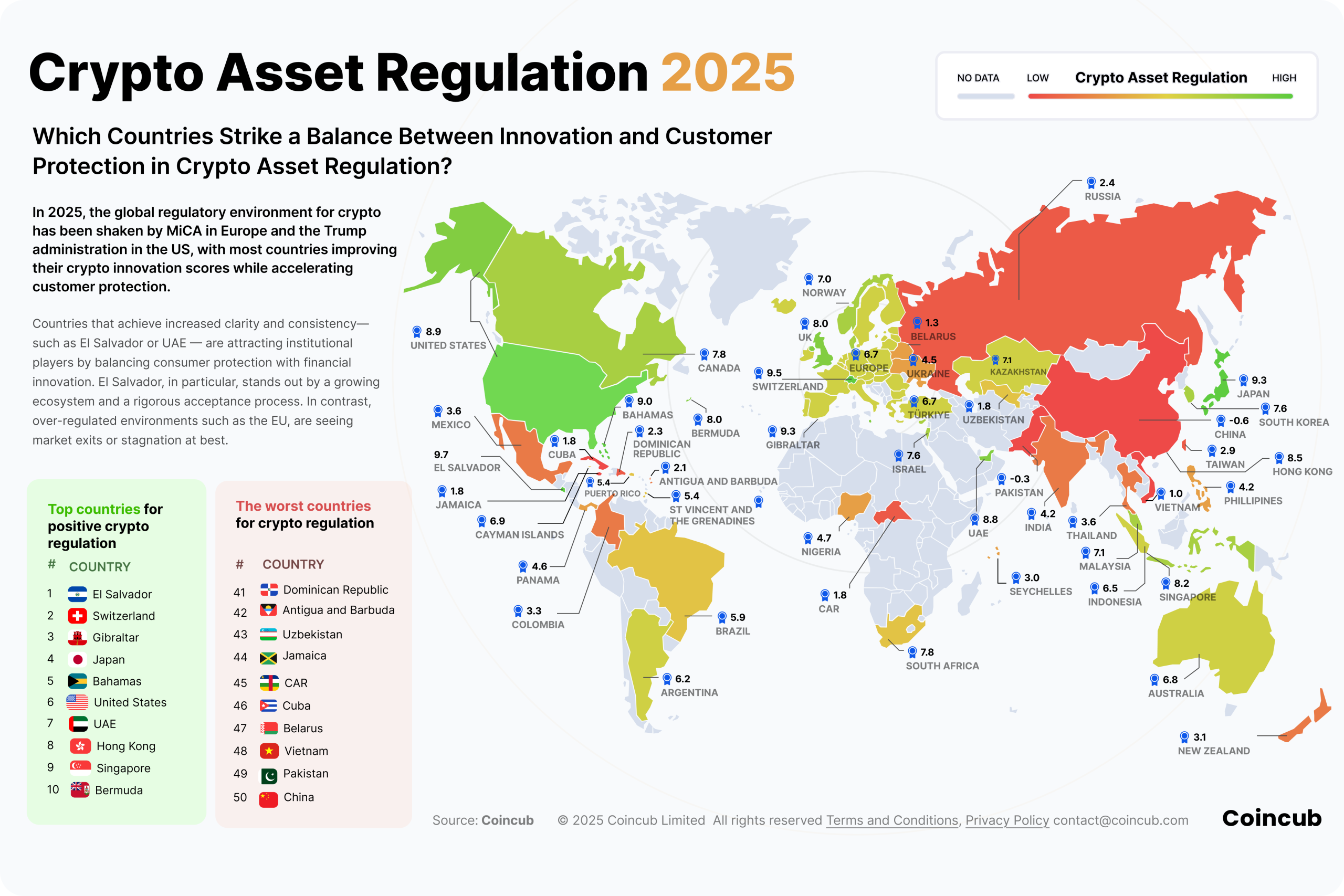

In addition to institutional players, the crypto community itself heavily influences regulation. Industry groups and advocacy organizations often lobby for more favorable regulations and work to educate policymakers on the nuances of blockchain technology. Simultaneously, developments in technology and market behavior can prompt quick shifts in regulatory stances, as seen with recent crackdowns and new proposals from various governments. Navigating this complex web of regulations requires continuous monitoring and engagement from all stakeholders to ensure a balance between innovation and consumer protection.

Counter-Strike is a popular first-person shooter game that has captivated gamers worldwide since its release. The game emphasizes teamwork, strategy, and skill as players engage in thrilling matches. For those looking to enhance their gaming experience, utilizing a betpanda promo code can provide excellent opportunities for bonuses and rewards.

Crypto Regulation Decoded: What You Need to Know as an Investor

The landscape of crypto regulation is constantly evolving, making it essential for investors to stay informed. Governments around the world are recognizing the need to regulate digital assets to protect consumers, curb illegal activities, and foster innovation. In the United States, regulatory agencies like the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) are actively developing frameworks to classify and oversee cryptocurrencies. As an investor, understanding the implications of these regulations can help you navigate the market more effectively and mitigate potential risks.

Moreover, staying updated on crypto regulation allows you to better gauge the compliance requirements for exchanges and wallets that you may use. Regulations can vary significantly by jurisdiction, which means that while one country might embrace cryptocurrency with open arms, another may impose strict limitations. It is crucial to monitor the news and follow reputable sources to ensure that you are making well-informed decisions. Ultimately, being proactive about understanding crypto regulation will empower you as an investor, helping you capitalize on opportunities while protecting your assets.

Is Your Crypto Wallet Safe? Navigating the Regulatory Landscape

As the cryptocurrency market continues to grow, the question on everyone's mind is: Is your crypto wallet safe? Security measures vary greatly between different types of wallets, ranging from hardware wallets that offer robust offline storage to software wallets that operate online and can be more vulnerable to cyberattacks. It's crucial to understand the regulatory landscape that governs these wallets, as regulations can influence the safety and practices of wallet providers. Keeping abreast of laws in your jurisdiction can help you choose a wallet that meets safety standards and offers the best protection for your assets.

Navigating the regulatory framework surrounding crypto wallets can be daunting, but it is essential for ensuring your crypto wallet safety. In many countries, regulations aim to protect consumers while promoting innovation. Familiarize yourself with the compliance measures required of wallet providers, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. By selecting a wallet that complies with these regulations and possesses a strong reputation, you can significantly reduce your risk of theft or fraud and enjoy peace of mind as you explore the world of cryptocurrency.