The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

Crypto Regulation Roll Call: What’s in Store for Your Wallet?

Stay ahead in the crypto game! Discover the latest regulations and how they impact your wallet in our in-depth Crypto Regulation Roll Call.

Understanding the Latest Crypto Regulations: What You Need to Know

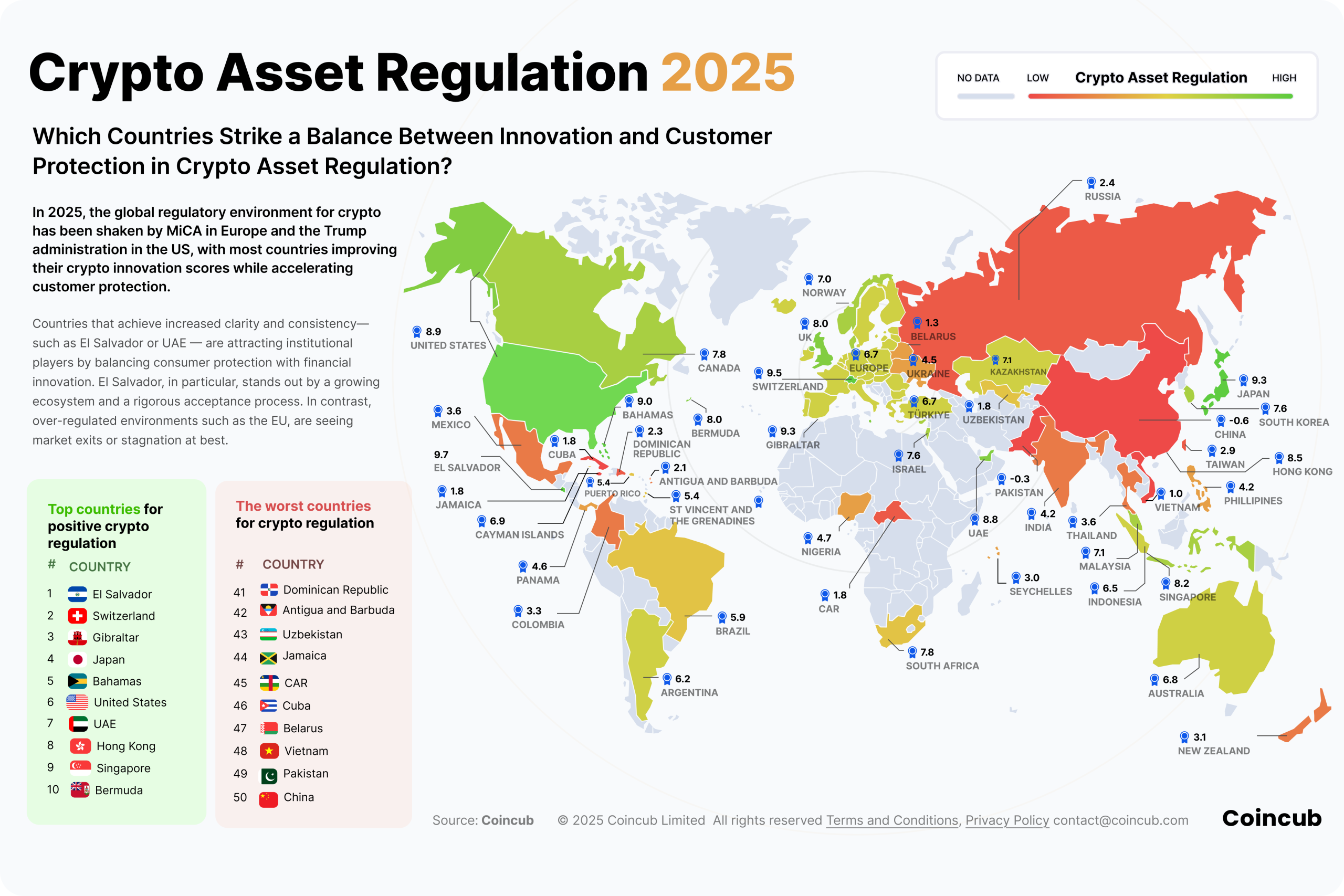

The landscape of cryptocurrency regulations is evolving rapidly, making it crucial for investors and enthusiasts to stay informed. Understanding the latest crypto regulations not only helps you navigate the complexities of compliance but also enables you to identify risks and opportunities in the market. In recent years, various countries have enacted laws aimed at curbing money laundering, protecting consumer interests, and ensuring fair trading practices. Key regulatory bodies, such as the SEC in the United States and the FCA in the UK, are actively working to establish guidelines that govern cryptocurrency exchanges and Initial Coin Offerings (ICOs). Staying ahead of these changes is essential for anyone involved in the crypto space.

Among the most significant developments in crypto regulations is the push for greater transparency and security in transactions. For instance, many jurisdictions are prioritizing the implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, requiring exchanges to verify user identities before allowing trading. Additionally, some countries have introduced tax regulations specifically for cryptocurrency investments, making it crucial to understand how these rules may affect your financial obligations. To ensure you are compliant, consider consulting with a legal expert who specializes in cryptocurrency law. This knowledge will empower you to engage both responsibly and strategically in the ever-evolving world of digital assets.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in a series of strategic battles. Players can enhance their gaming experience significantly, and utilizing bonuses can be beneficial. For example, you can explore betting on matches or tournaments with a betpanda promo code to gain some advantages.

How Global Regulatory Changes Could Impact Your Cryptocurrency Investments

As the cryptocurrency market continues to evolve, global regulatory changes are playing an increasingly pivotal role in shaping the landscape for investors. Governments around the world are working to establish frameworks that can either enhance or challenge the legitimacy of digital assets. For instance, recent legislative efforts in the European Union aim to implement stricter anti-money laundering regulations and tax reporting requirements for cryptocurrency exchanges. These regulations could potentially reduce fraud, leading to a more stable market, but they may also pose challenges for investors who prefer to operate in a less regulated environment.

Furthermore, compliance with these new rules often requires significant adjustments from businesses, which can trickle down to investors. A lack of clarity in regulatory policies can create uncertainty, making it crucial for investors to stay informed about the latest developments. For those holding cryptocurrencies, understanding how different regions implement regulations will be vital; for example, if a major economy enforces rigorous rules, it might affect the liquidity and trading volumes of certain assets, thus impacting their overall value. Keeping track of these changes can help investors make informed decisions, mitigating risks while capitalizing on potential opportunities.

Is Your Wallet Safe? Navigating Compliance in the Evolving Crypto Landscape

In today's rapidly evolving crypto landscape, ensuring the safety of your wallet has become more crucial than ever. With compliance regulations reshaping how digital currencies are managed, it's essential to stay informed about the latest legal requirements that affect your investments. Is your wallet safe? The answer lies in understanding the compliance challenges and leveraging best practices to enhance security. Key regulations, such as the Financial Action Task Force (FATF) guidelines and local laws, dictate how wallets should operate, emphasizing the necessity of implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

As the crypto market matures, awareness of potential risks and proactive compliance measures can safeguard your assets. To navigate this landscape effectively, consider the following strategies:

- Stay updated on regulatory changes: Regulatory frameworks are continually evolving, and being proactive is vital.

- Choose compliant platforms: Ensure that the wallets and exchanges you use adhere to pertinent laws and regulations.

- Secure your digital assets: Implement best security practices like two-factor authentication and regularly monitoring your wallet activity.