The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

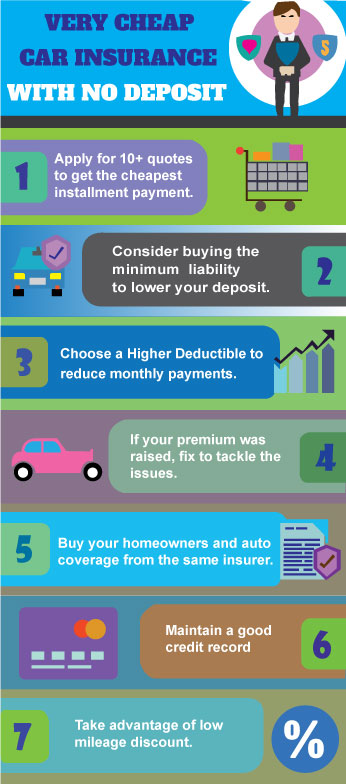

Cheap Insurance Hacks That Save You Big

Unlock secret tips to slash your insurance costs! Discover budget-friendly hacks that can save you big. Don't miss out!

Top 5 Insurance Discounts You Might Be Missing Out On

Many insurance policyholders are unaware of the various discounts available to them, which can significantly reduce their premiums. Here are the top 5 insurance discounts you might be missing out on:

- Multi-Policy Discount: Bundling your home and auto insurance can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record can earn you a discount.

- Good Student Discount: If you're a student maintaining a high GPA, you may qualify for a discount on your premium.

- Home Security Discount: Installing security systems can lower your homeowner's insurance.

- Low Mileage Discount: Driving less than average miles each year can earn you a discount as well.

How to Compare Insurance Quotes and Save Big

When shopping for insurance, comparing insurance quotes is crucial to ensure you’re getting the best deal. Start by gathering quotes from multiple providers, either by visiting their websites or using a third-party comparison tool. Create a list of key factors to compare, including coverage types, deductibles, and premium costs. Organize the information in a table to easily visualize the differences and similarities between each policy.

Once you have your quotes, assess each option carefully. Look beyond just the price; consider the customer service ratings and the financial stability of the providers. Sometimes a slightly higher premium could save you money in the long run through better coverage or fewer claims denials. Remember, the goal is not just to find the cheapest policy but to find the best value for your needs. Being thorough in your comparison can lead to significant savings and peace of mind.

Are You Paying Too Much? Common Insurance Mistakes to Avoid

When it comes to insurance, many individuals unknowingly make common insurance mistakes that can lead to paying more than necessary. One of the most prevalent errors is failing to shop around for the best rates. Many people assume their current policy is the best option available, which can result in inflated premiums. It's advisable to compare quotes from multiple providers, as they can vary significantly. Additionally, be sure to evaluate your coverage needs; often, consumers pay for coverage they don't need or miss discounts they are eligible for.

Another critical mistake is not reviewing policies regularly. Life changes, such as moving, marriage, or having children, can impact your insurance needs. Failing to update your policy accordingly may lead to being underinsured or overpaying for coverage that no longer aligns with your current situation. It's essential to periodically review your insurance policies and adjust your coverage to match your evolving needs. Consider consulting an insurance expert to help identify areas where you can save money.