The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

Cyber Liability Insurance: Your Business's Secret Shield Against the Digital Dark Side

Unlock the secret to safeguarding your business! Discover how cyber liability insurance protects you from digital threats today.

What is Cyber Liability Insurance and Why Does Your Business Need It?

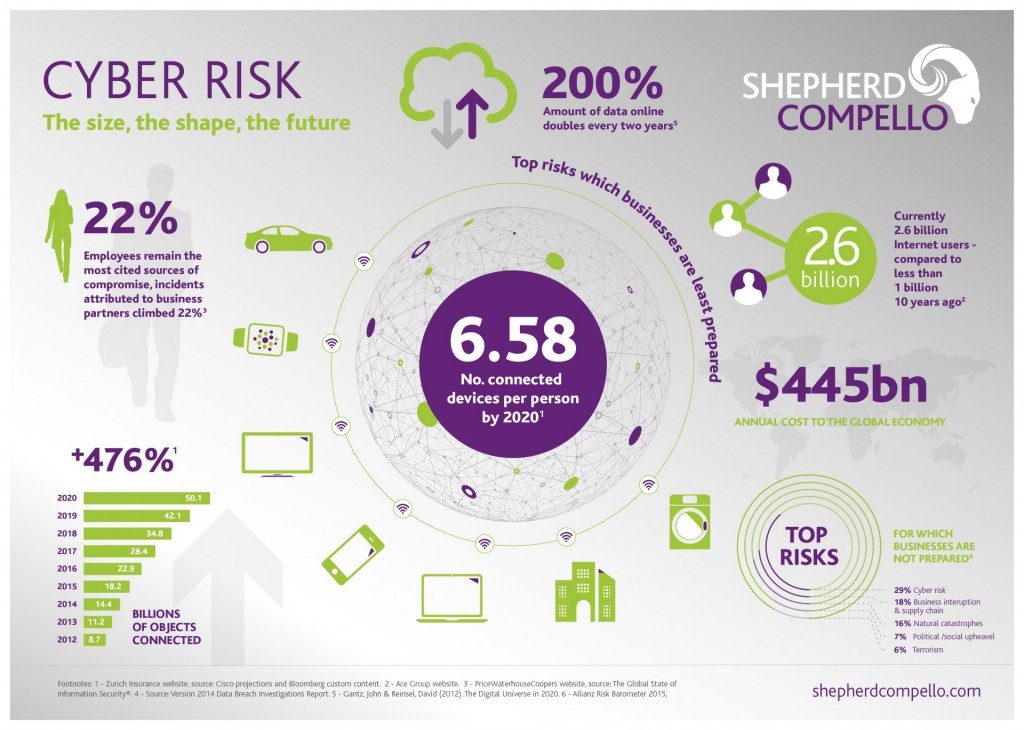

Cyber liability insurance is a specialized form of insurance designed to protect businesses from financial losses resulting from data breaches, cyberattacks, and other internet-related risks. In today's digital age, where information is a critical asset, businesses of all sizes are vulnerable to cyber threats. This insurance typically covers costs associated with data breaches, such as legal fees, notification costs, and public relations expenses. Additionally, it may also provide protection against the loss of income due to a cyber incident, helping businesses recover quickly and efficiently.

The necessity of cyber liability insurance cannot be overstated. As hacking incidents and data breaches become increasingly common, having this coverage can provide peace of mind and financial support during a crisis. According to recent studies, a significant percentage of small to medium-sized businesses experience cyber incidents every year, which can lead to devastating financial consequences. Investing in cyber liability insurance is an essential step for businesses to mitigate risks, safeguard their reputation, and ensure their long-term viability in an unpredictable digital landscape.

Top 5 Benefits of Cyber Liability Insurance for Small and Medium Enterprises

In today's digital landscape, small and medium enterprises (SMEs) face a growing number of cyber threats that can lead to devastating financial losses and reputational damage. Cyber liability insurance provides a crucial safety net for these businesses, offering a range of benefits that can help mitigate risks. Here are the top 5 benefits of having cyber liability insurance:

- Financial Protection: This insurance covers costs related to data breaches, such as legal fees, notification costs, and credit monitoring for affected customers.

- Data Breach Response: Cyber liability insurance often provides access to a network of professionals who can assist in managing a data breach response.

- Regulatory Compliance: It helps businesses comply with data protection regulations, potentially saving them from hefty fines.

- Reputation Management: In the event of a cyber incident, having insurance can help maintain customer trust through effective public relations strategies.

- Peace of Mind: With coverage in place, business owners can focus on growth and innovation rather than constantly worrying about cyber threats.

Is Your Business at Risk? Understanding the Importance of Cyber Liability Coverage

In today's digital age, cyber threats are an ever-present risk, making cyber liability coverage essential for businesses of all sizes. With incidents of data breaches, ransomware attacks, and identity theft on the rise, companies need to protect themselves against the financial repercussions that can follow such events. Without adequate coverage, your business could face substantial legal fees, customer notification costs, and potential fines, which could threaten its very survival. Understanding the specific risks your business faces is the first step towards making informed decisions about your insurance needs.

Moreover, cyber liability coverage not only shields your business from financial loss but also helps maintain your organization's reputation and customer trust. Implementing effective cybersecurity measures, alongside securing the right insurance policy, provides a comprehensive approach to risk management. Consider the following factors:

1. Evaluate your data security practices.

2. Determine the type of data you handle.

3. Assess your exposure to third-party risks.

By proactively addressing these areas, you can better understand the importance of cyber liability coverage and ensure that your business is prepared to address any cyber threats effectively.