The Bench Team Chronicle

Insightful news and updates from the world of sports and teamwork.

Cheap Insurance: Pocket-Friendly Protection That Packs a Punch

Unlock affordable insurance options that offer solid protection without breaking the bank. Discover your budget-friendly solution today!

How to Find Affordable Insurance Without Compromising Coverage

Finding affordable insurance can feel daunting, especially when you want to ensure that your coverage is not compromised. Start by conducting thorough research and comparing different policies. Utilize online comparison tools that allow you to input your specific needs and receive quotes from various providers. This will help you identify which insurers offer the best rates for the coverage you require. Pay attention to the terms of each policy; sometimes, lower premiums come with higher deductibles or reduced coverage limits. Prioritize understanding what each policy covers to make a well-informed decision.

Another effective strategy is to bundle your insurance policies. Many companies offer discounts when you purchase multiple types of insurance (such as auto and home) together. Additionally, consider adjusting your coverage limits to align with your current needs; for instance, if you have older vehicles, you might opt for lower coverage on those. Don't hesitate to ask providers about any discounts available for safe driving records, loyalty, or membership in certain organizations. By taking these steps, you can find affordable insurance that keeps you well-covered without breaking the bank.

Understanding the Benefits of Cheap Insurance: Is It Right for You?

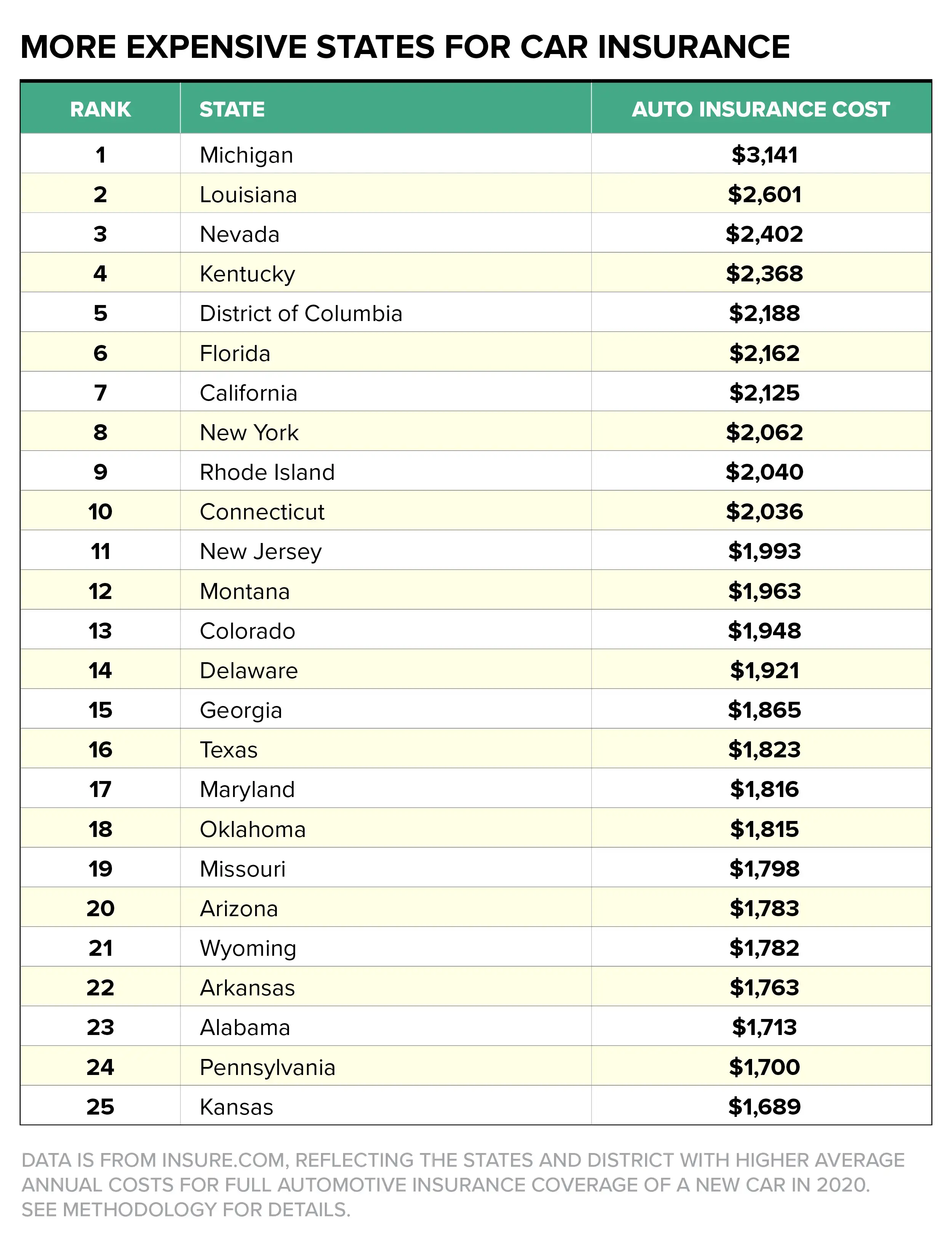

When it comes to selecting insurance, many individuals often find themselves pondering whether cheap insurance truly meets their needs. The primary benefit of opting for lower-cost insurance is the obvious savings on monthly premiums, allowing policyholders to allocate their resources elsewhere. Furthermore, affordable insurance plans can offer basic coverage that satisfies legal requirements, such as auto insurance mandates, giving you peace of mind without breaking the bank. However, it is crucial to evaluate what exactly you are getting for the lower price, as sometimes 'cheap' can translate to inadequate coverage or high deductibles.

It's important to weigh your options carefully. While cheap insurance can be an attractive choice for those on a tight budget, it's not a one-size-fits-all solution. Consider the following factors:

- Assess your coverage needs: Make sure the policy covers essential aspects of your life or property.

- Understand the limitations: Cheap insurance might come with numerous exclusions and limitations that could leave you vulnerable.

- Evaluate the insurer’s reputation: Sometimes, the savings come at the cost of poor customer service or slow claims processing.

Top 5 Tips for Saving on Insurance Costs While Staying Protected

Finding ways to save on insurance costs is essential for maintaining financial health, especially as premiums continue to rise. Here are top 5 tips to help you cut your expenses while ensuring you remain adequately protected:

- Shop Around: Take the time to compare quotes from multiple insurance providers. Each company has its own pricing models, so you may find significant savings by switching.

- Review Your Policies: Regularly assess your existing policies to ensure you’re not paying for coverage you no longer need. Canceling or adjusting coverage can lower your premiums without sacrificing essential protections.

3. Bundle Your Policies: Many insurance companies offer discounts for bundling multiple policies, such as home and auto insurance. This can lead to considerable savings while still getting comprehensive coverage. 4. Increase Your Deductibles: A higher deductible can lower your premium significantly. However, make sure that you have enough savings to cover the deductible in case of a claim. 5. Take Advantage of Discounts: Look for available discounts such as those for safe driving, good grades, or military service. Utilizing these can lead to substantial savings on your overall insurance costs.